Daigou 2.0: the Transition From Hessian Shopping Trolley to Omnichannel Sales Model

Daigo 2.0 - the transition from hessian shopping trolley to omnichannel sales model

Aleisha Lee CPA

1 March 2021 | 7 minutes read

Gone are the days when international university students and Chinese aunties with hessian shopping trolleys sweeping baby formula off the shelves while frantically WeChatting their buyers in China to finalise the transaction, choking up almost every Chemist Warehouse store, making parents furious over baby formula shortages. Desperate mums like myself had to scour pharmacies, supermarkets, Kmart, Big W, eBay, Amazon, you name it, for a tin of organic infant formula for my baby boy. It was an ongoing struggle until the coronavirus pandemic hit our shores and government closing the border to all international travellers. Overnight, it upended inbound tourism and disrupted the entire Daigou ecosystem and the logistics network.

Australian products such as milk, honey, wine, health supplements, UGG boots and baby care are sought after in China, thanks to the ‘clean’ and ‘green’ reputation of Australia, high quality and safety standards. The emergence of an affluent middle-class of seeking more ‘international’ products has also fuelled the enthusiasm for Australian products. Chinese consumers are generally highly brand conscious, parents are willing to buy expensive baby products given the strong association of price with quality. Back in the golden days, a tin of baby formula cost an average of $28 in Sydney, the same product could be sold for up to $100 in China. Taking out the international shipping for a 900g tin at approximately $32, Daigou would net a very impressive profit of $40 per tin. Daigou profits usually come from price arbitrage and sometimes from product scarcity.

What is Daigou?

‘Daigou’ - Chinese for ‘buy on behalf of’, are buying agents, personal shoppers. Usually they are friends and families, or friend of a friend who has direct rapport and personal trust with the clients in China.

AuMake, a Daigou specialty business listed on ASX, told ABC News that "the Daigou market is worth at least $2.5B in Australia." While it is almost impossible to put an exact dollar figure on the size of the industry but Daigou is a global phenomenon and we know that Daigou is big business.

2020 has been a life-changing year for everyone living on this planet. From getting used to wearing a mask in public to losing love ones to the virus. It was truly devastating. Before the pandemic, there were an estimated 150,000 Daigous scattered across Australia and about 1,000 Daigou stores catering to the Chinese demands for Australian products, now most of them are permanently closed.

Impact of the Daigou exodus

At the beginning of 2020, the Chinese economy shrank for the first time since the end of cultural revolution in 1976, ending a near half-century economic growth. There has also been a shift in consumer behaviour for imported products in China. Travel restrictions and disruptions to logistics network in the wake of the pandemic had serious effects on a slew of Australian companies relying heavily on doing business in China through the traditional Daigou sales channel.

Orders for Australian-made products plummeted to an unprecedented level and the Daigou industry almost vanished. Blue Sky Express – a major logistic provider once claimed to have a market share of more than 60 percent of Daigou trade in Australia, went into liquidation in May last year and thousands of parcels remain missing still.

A2 Milk Company, a New-Zealand based company dually listed on both ASX and NZX, a one-time market darling, had its market capitalisation sinking over 50 percent in just 6 months to just AU$6.5B. Documents lodged with ASX have revealed some very negative news. The company has heavily downgraded the full-year outlook after disappointing half-year results with earnings falling over 32 percent due to disrupted Daigou trade. Investors continue to hammer the stock and the share price has plummeted from its all-time high of AU$20.05 in July 2020 to just AU$8.77 at the time of writing this post.

Swisse vitamins also suffered a 36 percent slump in revenue to AU$127M in Australia and New Zealand.

Another ASX-listed Daigou specialty business that are bleeding is Mediland Pharm. Share price has so far lost two-thirds of its original IPO value. The company has shut down all of its retail operations in Australia and placing its subsidiary companies into administration. According to its latest ASX announcement, the company has reported total revenue of AU$727K, a whopping 96 percent drop from the same period last year and it has also reported a loss of AU$5.5M across the group.

As Daigou sales dry up, Bubs Australia is also feeling the pain. Bubs Australia is a goat milk infant formula company. In the latest financial reports, the company has reported an EBITDA loss of AU$14.4M and gross revenue tumbled 33 percent in the six months ended December 31, mostly due to the collapse in the Daigou sales channels.

Daigou 2.0: transition to omnichannel sales model

To revive the industry, it needs physical foot traffic, inbound tourism needs to resume and international students need to return. On 2 March, the government extended the international border ban until June this year, citing the emergence of a highly transmissible variant of Covid-19. Although Australia is slowly returning to the new normal and a lot of places are no different to what it used to be before coronavirus. There are signs that some of the retail Daigous are returning, packing the car boot full of baby formulas. But most of the retail Daigou shoppers that would empty shelves at the supermarkets and pharmacies have already transitioned to e-Commerce and social commerce in order to stay in business.

Omnichannel is a fancy way of saying smooth shopping.

Daigous are now engaging in social sharing and social e-commerce. They are transforming themselves from being Daigou shoppers to social media influencers and brand promoters. Those with warehouses are also upgrading their industrial premise to live streaming studios in order to connect Chinese consumers and Australian brands.

What is social commerce?

Social commerce involves buying and selling products through social media networks. It is the added ability on social media platforms to purchase products without leaving the app. The buying decision is based on opinions within the social network and consumers rely less on information provided by the brands and advertisers. It is about discovering products with friends and families, sharing that shopping experience and buying on the same platform.

With the rise of major social commerce platforms like China’s Pinduoduo, Tmall Global, Kaola, Xiaohongshu (Little Red Book), WeChat’s Good Product Circle, together with the emergence of a new consumer class in China – the affluent, sophisticated and tech savvy millennials, have fuelled the growth of the social commerce revolution. Latest research by eMarketer says that "the social commerce market in China accounts for 11.6 per cent of total retail e-Commerce sales, totalling US$186B in 2019 and is estimated to be worth US$474B by 2023."

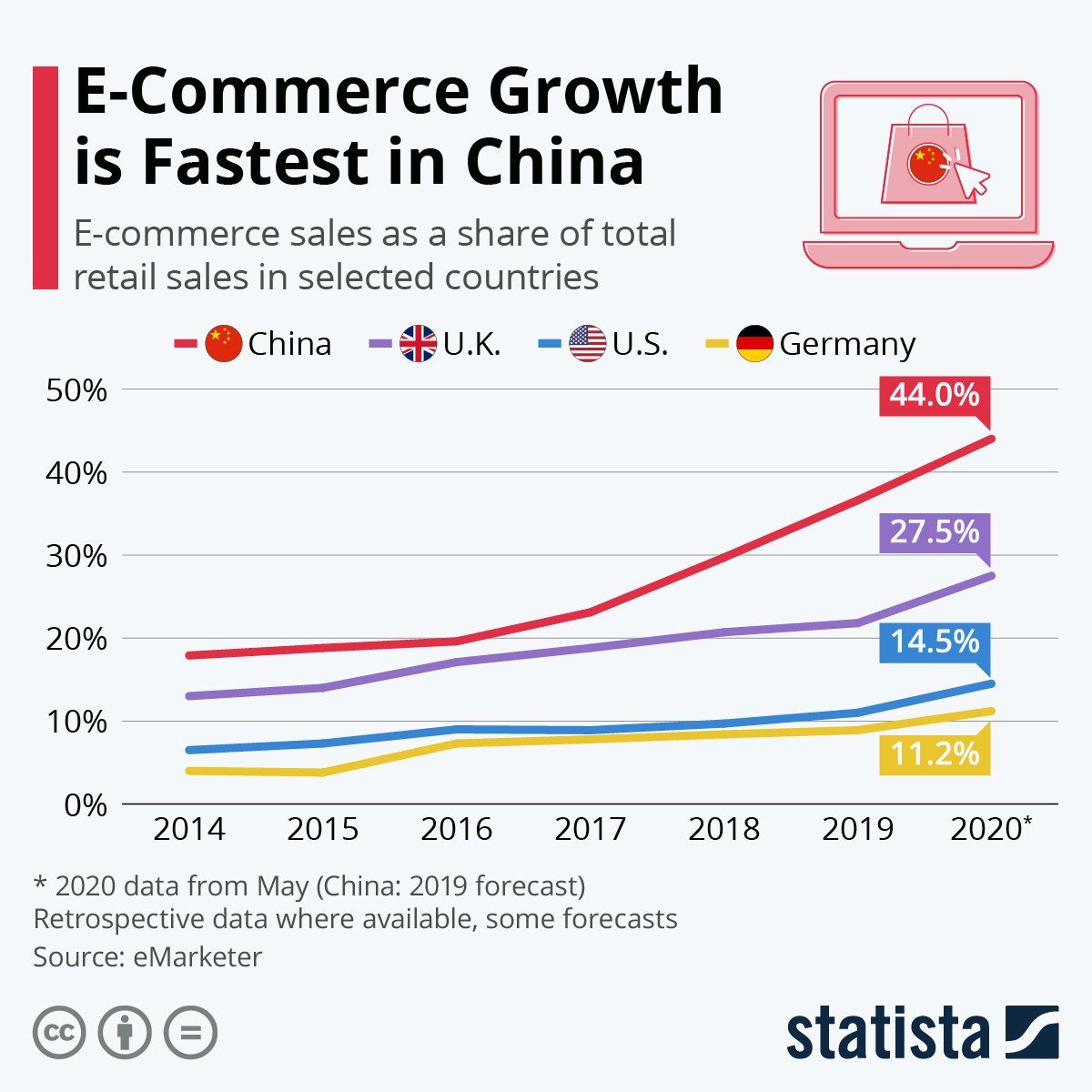

Vincent Digonnet, Executive Chairman of Asia Pacific at Razorfish, a global leader in digital marketing innovation and a full-service agency offering strategic, creative, technical and media solutions has made a conclusion that "China is a decade ahead of western countries in e-Commerce".

'The Perfect Overlap"

| Firstly, there is a perfect overlap between the population of social media and consumers with purchasing power, and that overlap that doesn't exist in western countries because in the west, general population on social media is less than 25 years of age and people with money are often more than 55 year of age. In comparison, people on social media in China are older and people with money are younger.

"Chinese are massive content creator"

| Second contributing factor is that the Chinese are massive creator of content, according to Vincent. In western countries, statistics show that only 1 out of 100 people would create the original content, while 9 people would retweet and the rest of the 90 people are purely spectators. While in China, the statistics suggest that 30 out of 100 people are genuine creator of content, 50 people retweet, comment those contents and only 20 out of 100 are passive spectators.

These are the two main reasons why China is 10 years ahead of western counterparts in e-Commerce.

| In 2020, according to Statista, “the revenue of e-Commerce in China is expected to show an annual growth rate (CAGR 2020-2024) of 6.9 percent, resulting in a market volume of US$1,309,535M by 2024.”

In Australia, some digital marketing and consulting companies are rebranding themselves as corporate Daigous. These companies recruit retail Daigous as individual distributors and subcontractors on their corporate platforms by managing and streamlining the entire process of product procurement, delivery, and other logistics and administrative issues on their behalf. The retail Daigous don’t have to outlay any money to buy the products before re-selling them. Every part of the transaction is handled by the corporate platform.

Responding to the 55 percent decline in daigou channel sales, Bubs Australia has adapted new sales channel that includes online to offline (O2O), livestreaming e-commerce and social selling, as well as offering delivery from Australia or from Chinese warehouses directly to consumers, in an effort to revive dwindling sales.

AuMake has also joined the trend on the social commerce. The company launched an online marketplace that aims to connect Australian brands to Asian influencers and their social networks while providing influencers with lower prices for their fans. Brands that have taken initiatives and embraced the new e-Commerce and social commerce revolution included Kabrita, Karicare, Nuchev and Karihome, while some have not yet responded to the emerging trend.

Some final words

The coronavirus pandemic has shaken up the Daigou industry. Although there are signs that Daigous are returning and momentums are picking up, however, the future of traditional Daigou trade will never return to pre-Covid levels of activity and will continue to face a period of unprecedented challenges. The shakeup is an elimination process that eradicates companies with operational and management deficiencies and are failing to reshape and adapt, but companies that can move along with the revolution and are responsive to new alternative ways to command engagement and build strong connections with consumers will survive and thrive in the post-Covid 19 world. Like the old famous phrase by British economist Herbert Spencer – ‘Survival of the fittest’. And it’s so true.

References

Patrick D, The Daigou channel is different, not gone, AFR, Nov 2019, https://www.afr.com/companies/retail/the-daigou-channel-is-different-not-gone-20191106-p537ze

Bang X, Chinese personal shoppers and Australian brands devastated by the impact of coronavirus, Oct 2020, https://www.abc.net.au/news/2020-10-17/has-daigou-disappeared-in-australia-during-coronavirus-pandemic/12761376

Dean B, Coronavirus to have “significant” effect on economy, daigou trade, Insider Retail, Feb 2020, https://insideretail.com.au/news/coronavirus-to-have-significant-effect-on-economy-daigou-trade-202002

eMarketer, Sep 2020, Coronavirus Impact: Share of Luxury Goods Spending Among Luxury Goods Buyers in China, by Channel, 2019 & 2020* (% of total), https//eMarketer.com

Disclaimer

This article is for general informational purposes only. I give no warranty and accept no responsibility or liability for the accuracy or the completeness of the information and materials contained in this article and on this website. Under no circumstances will I be held responsible or liable in any way for any claims, damages, losses, expenses, costs or liabilities whatsoever (including, without limitation, any direct or indirect damages for loss of profits, business interruption or loss of information) resulting or arising directly or indirectly from your use of or inability to use this website or any websites linked to it, or from your reliance on the information and material in this article and on this website.