arlier this week, multiple sources reported a major development in the crypto space: The U.S. Securities and Exchange Commission (SEC) has reached out to seven issuers of Solana Spot ETFs, including Fidelity, 21shares, Franklin, Grayscale, Bitwise, Canary, and VanEck, requesting updated S-1 statements within the next week for the proposed Solana (SOL) Spot ETFs - with a notable emphasis on including staking feature. This move suggests that SEC approval may be closer than the market expected, signalling yet another breakthrough in crypto's journey into mainstream finance.

Solana Spot ETFs - Wall Street Meets Web3

Aleisha Lee, CPA, Licensed Real Estate Agent (Queensland)

16 June 2025 < 3 minutes read

The Uniqueness of SOLANA

While

Ethereum (ETH) still leads in terms of market capitalisation and ecosystem maturity, its dominance in the smart contract platform has diminished and its position is being challenged.

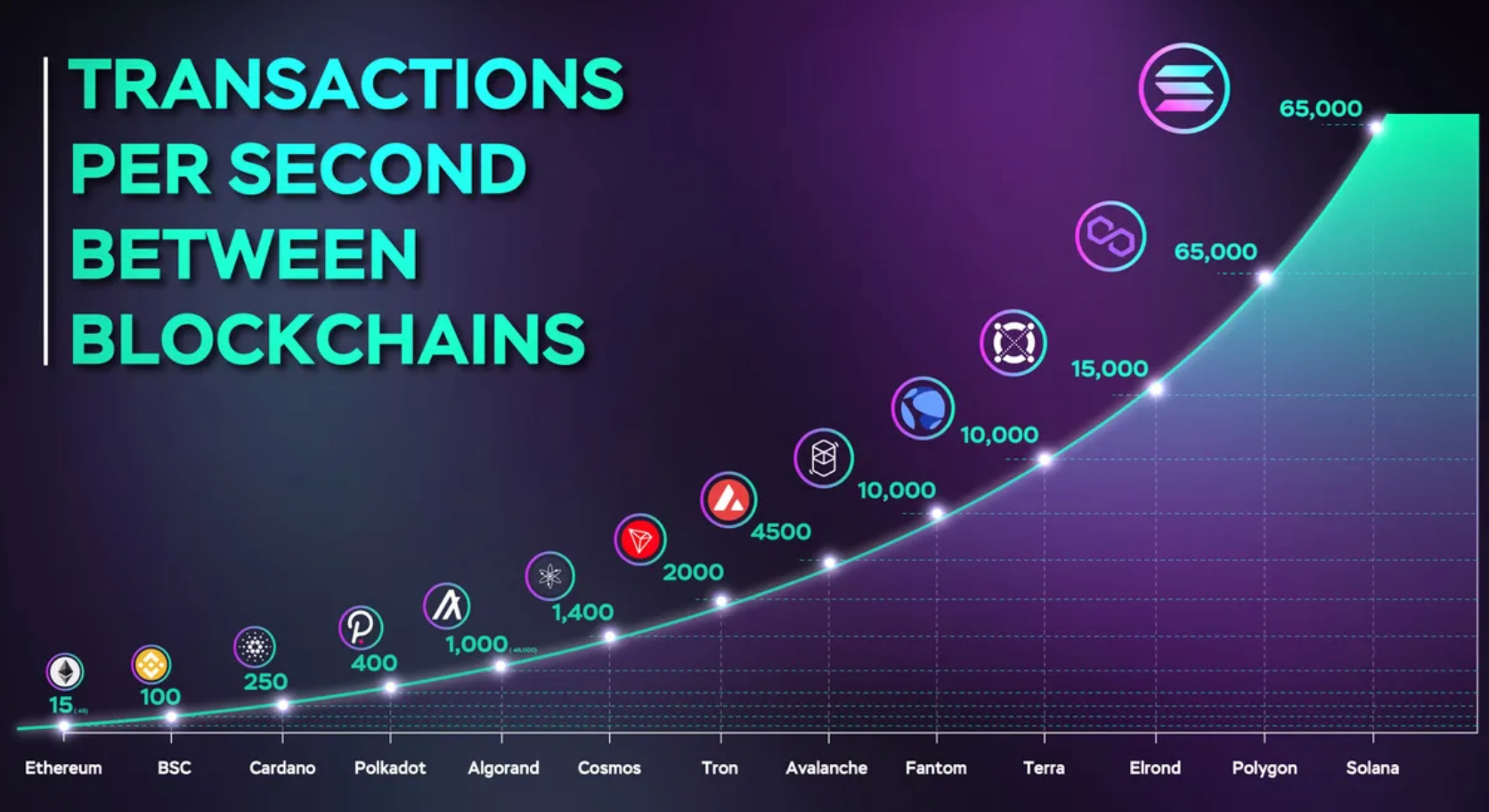

SOL represents a new wave of blockchain technology: ultra-fast, low-cost, and developer-friendly. SOL typically costs a fraction of a cent, around $0.00025 per transaction and has a theoretical capacity of up to 65,000 transactions per second (TPS). This is largely due to its unique consensus mechanism, which combines

Proof-of-History (PoH) and

Proof-of-Stake (PoS) to streamline how transactions are ordered and validated. ETH, by contrast, processes 15 to 30 TPS at around $0.02 per transaction and BTC doesn't have specific use cases beyond being a store of value and a unit of exchange.

Source: The Solana Daily

It is clear that SOL's highly-anticipated spot ETF approval reflects not just regulatory momentum shift but a growing institutional interest in alternative Layer 1s. Once approval is granted, this would mark the first time an altcoin beyond ETH is approved for direct market exposure via an ETF product, breaking new ground for what is considered "institutional-grade" in crypto.

Understanding ETFs

Exchange-Traded Funds (ETFs) are investment vehicles designed to track the performance of a particular index, sector, commodity, or other asset class. They enable investors to buy their shares on stock exchanges and gain exposure to a diversified portfolio without needing to purchase each asset individually.

For traditional markets, Solana Spot ETFs approval will mark a major disruption. These ETFs offer both retail investors and institutional players with simplified, regulated gateway into the crypto space -

no private keys, no wallets, just pure price exposure through familiar financial instruments.

Furthermore, Solana brings more to the table than accessibility alone. It's a thriving ecosystem powering DeFi, NFTs, tokenisation, and even integrations with giants like Visa. An ETF tied to such a dynamic network introduces traditional capital to a far more active and utility-driven crypto economy than BTC and ETH can offer.

Crypto Market Surge

As evidenced in the latest Crypto Market Capitalisation published

by CoinMarketCap, the crypto market continues to demonstrate strong momentum, with total market cap reaching $3.44 trillion in May 2025, despite the recent market sell-offs. This uptrend reflects renewed institutional interests, increased retail participation, and the expanding adoption of blockchain technologies across various sectors.

BTC and ETH Spot ETFs have both laid the foundation for regulated crypto investing, and their success is a testament to investor appetite. As the crypto ETF market expands, so too will the variety of available financial instruments, from spot ETFs to crypto options, and perhaps eventually, crypto derivatives.

The much-anticipated regulatory nod for Solana Spot ETFs won't just accelerate mainstream adoption - it will reinforce the maturity, credibility, and resilience of the broader crypto ecosystem. The financial world is taking notice, and it is time for us to pay attention.

Source: BTC.Inc

Trump 2.0 - New Era for Crypto

With a pro-crypto government taking shape - and a sitting U.S. Vice President JD Vance making history by addressing the Bitcoin 2025 Conference in Las Vegas last Wednesday, promising to eliminate aggressive regulation and promote a pro-growth framework for crypto - it's clear we are witnessing a defining moment for the industry.

"Crypto is a hedge against bad policy making from Washington, no matter what party is in control... I am here today to say loud and clear with President Trump, Crypto finally has a champion and an ally in the White House."

- Vance told the Crowd at Bitcoin 2025 Conference, LA.

For years, the crypto industry faced staunch resistance from regulator under the previous administration, with the SEC repeatedly rejecting ETF applications, citing concerns around market manipulation, custody, and investor protection. It wasn't until a pivotal lawsuit against the SEC - ruled in favour of Grayscale - that ultimately led to the approval of BTC ETFs on 10 January 2024, followed by ETH ETFs on 23 May 2024.

Wall Street Meets Web3

Now, all eyes are on SOLANA. When approved, SOL Spot ETFs would introduce Wall Street to a new kind of digital asset: one that goes beyond BTC's store-of-value narrative, or ETH's programmable infrastructure, SOL offers a lightning fast, scalable, high-performance network powering real world use cases from tokenised payments and decentralised trading to Web3 gaming. Its entry into ETF space could fundamentally reshape portfolio strategies, accelerate the adoption of on-chain financial products and blur the lines between Wall Street and blockchain innovation. Rather than simply coexisting with traditional markets, Solana represents the next wave of crypto assets poised to challenge, compete with, and ultimately redefine Wall Street.

Disclaimer

This article is for general informational purposes only. I give no warranty and accept no responsibility or liability for the accuracy or the completeness of the information and materials contained in this article and on this website. Under no circumstances will I be held responsible or liable in any way for any claims, damages, losses, expenses, costs or liabilities whatsoever (including, without limitation, any direct or indirect damages for loss of profits, business interruption or loss of information) resulting or arising directly or indirectly from your use of or inability to use this website or any websites linked to it, or from your reliance on the information and material in this article and on this website.