Aleisha Lee,

CPA

29 April 2021 | < 15 minutes read

Crypto is a fascinating space.

With the rise of teen traders like

Erik Finman, who made millions of dollars from crypto; Sydney schoolboy

Sam Cornock making his first $10,000 AUD from trading digital currencies, and kids as young as eleven publishing a 57-page book on Bitcoin. Children are jumping on this emerging technology much faster than we think.

Just a few days ago, my tech-savvy 8-year-old boy from the so-called "Generation ALPHA" asked me to buy him a pet dragon from a popular digital dragon warrior game that runs on the Ethereum blockchain. The game centres around breedable, collectible, and very adorable creatures called the

HyperDragons.

He explained that each dragon is one-of-a-kind and the green dragon that he wanted holds an enticing future promise that dragons will one day rule the planet. Therefore, he planned to train this little guy to protect the dragon castle, defend the floating islands and fight off any invaders coming onto the land.

These dragons come with specific attributes, skills, and unique appearances, and they are collectibles enabled by NFTs that players can exchange or transfer on the marketplace. He was keen to start his dragon collection. This particular creature was listed for sale at 1 ETH (equivalent to $3506 AUD at the time of publishing this post) on

OpenSea.io - a P2P marketplace for crypto collectibles, like eBay for NFTs.

In short, NFT stands for

Non-Fungible Token. Non-Fungible is not a word that we hear often.

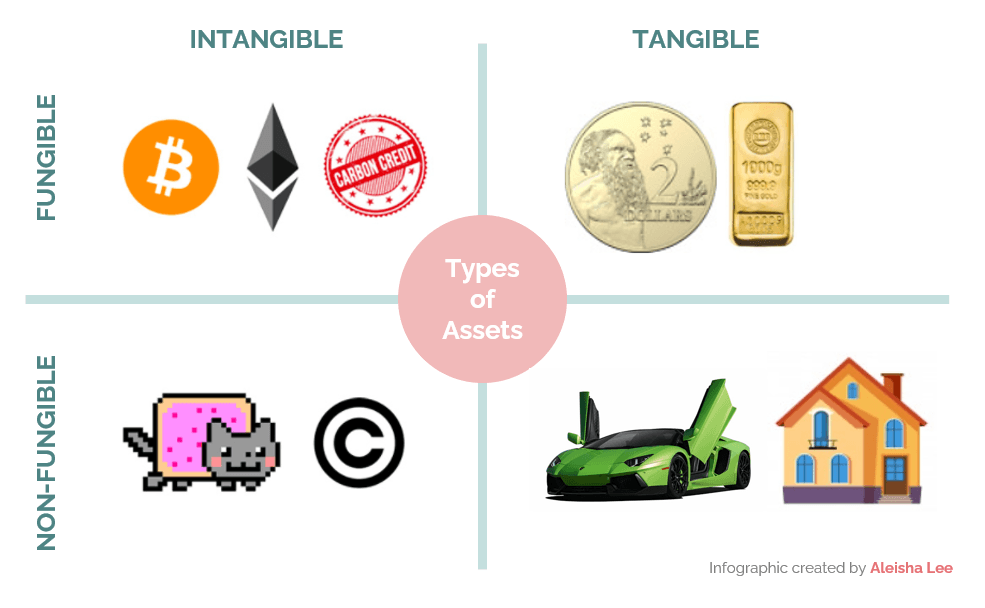

So, what does Non-Fungible mean?

Source: Infographic created by Aleisha Lee

Fungibility

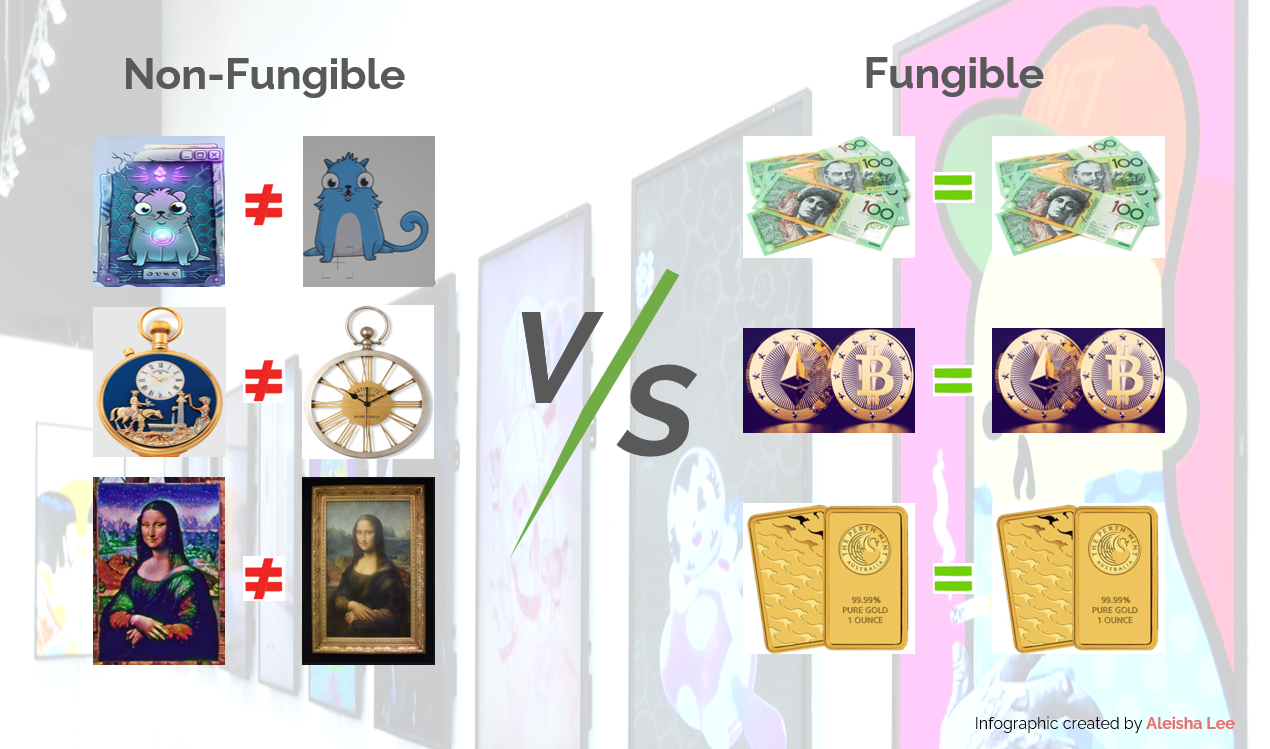

in economics is a characteristic of goods or commodities where each unit is interchangeable and indistinguishable. For fungible items, they are defined by their value rather than their properties; therefore, they can be exchanged. For example, ETH or dollars are fungible because 1 ETH / $1 USD is exchangeable for another 1 ETH / $1 USD.

Non-fungible is where each unit is unique and has individual properties, provably scarce with only one copy created on the blockchain, indivisible and fraud-proof. Things like photos, a meme, voice recordings, achievements, house and so on. These are things considered non-interchangeable with other items because each of them has unique properties.

Source: Infographic created by Aleisha Lee

Typical characteristics of NFTs:

- Uniqueness.

Each NFT has different properties which are stored, with metadata linking to the actual content of the NFT on a centralised blockchain server.

- Provably scarce.

There is usually a limited number of NFTs, such as only one copy, and the number of tokens can be verified on the blockchain, hence its provability.

- Indivisible.

Most NFTs cannot be split into smaller denominations, so you cannot buy or transfer a fraction of your NFT.

- Guaranteed ownership rights.

Like standard tokens, NFTs guarantee ownerships that can be easily transferred from one owner to another, and it is fraud-proof. NFTs can be implemented on any blockchain that supports smart contract programming, such as ERC-721 and ERC-1155 on the Ethereum network.

Let's get a bit geeky. How Do NFTs Work? What is the difference between

ERC-20,

ERC-721

and

ERC-1155?

Source: Ethereum Stack Exchange

ERC-20

is a well-known standard for creating tokens on the Ethereum blockchain. It creates

fungible

tokens, so all the tokens are completely indistinguishable. The value of each token is the same. Take

DAI

Stablecoin as an example, DAI is an ERC-20 token created on the Ethereum blockchain that has a steady value of $1 USD. Another example is DeFi token

UNI, which is a decentralised crypto exchange that runs on the Ethereum blockchain. It allows the swapping of ERC-20 tokens without the need for buyers and sellers to create demand.

Powered by the concept of digital shortage,

ERC-721

creates

non-fungible

tokens where the tokens' intrinsic value is defined by their rarity and their unique properties. It makes ERC-721 tokens very reminiscent of collectibles. In other words, each token is unique in its entire existence and cannot be replicated or destroyed. When an ERC-721 token is created, only one copy exists. Users can create their own ERC-721 tokens by writing a piece of code in a smart contract that follows a basic template and then adding unique details about the token. These unique details can include the name of the owner, rich metadata or secure file links. ERC-721 tokens are, therefore, more appealing to its future buyers or otherwise known as 'collectors'.

While

ERC-1155

is the next step in creating non-fungible tokens. The standard allows for trading contracts that support

both fungible and non-fungible

tokens. In digital games such as the

World of Warcraft, it holds fungible items such as gold and arrows and non-fungible tokens such as armour, swords, shields or the rare

Big Love Rocket. The ERC-1155 standard allows the developer to define both fungible and non-fungible tokens and decide how many of these tokens should exist.

Another blockchain-based game that is leveraging the power of NFTs is

Decentraland, where the players can buy parcels of digital land that later resold or even used as advertising space within the game.

The

elusive, pink and rideable Big Love Rocket is one of the non-fungible items from the Valentines' Day event in the

World of Warcraft. With the estimated drop rate of 0.03 per cent, it is the lowest dropped item in the game and the chances of catching this suggestively-shaped vehicle are the same as the chances of being struck by lightening once in your lifetime.

NFT is revolutionising the world of gaming

It isn't surprising that gaming has been described by many as the gateway to the mass adoption of blockchain technology. The gaming industry surpassed both the music and movies industries combined a long time ago in terms of revenue. According to

Statista,

| a total of 2.81 billion people are playing video games around the world, which represents more than a third of the global population.

So why is NFT such a big deal in gaming?

These tokens can help alleviate some issues that game developers and players experience under the current model. For players, the main problem is

not owning their digital assets.

When they are disqualified or banned from the games, their assets will be lost. If the player wants to sell the digital items purchased in the game, such as the helm, swords or pendulum, the

sale of these assets will be restricted

by the developer's company policy. Taking these digital items out of the game is also impossible. That means the players are just borrowing the items at a cost from the game developer.

NFTs can change that.

By tokenising the assets, gamers have

complete control over their assets. They can take them out from the developers' server into a blockchain network. The security of the assets will also be guaranteed on the blockchain. Players will truly be awarded for their efforts in acquiring the assets as it wouldn't matter if the developers go out of business or the game disappears.

Blockchain will ensure that player's assets will still be there. It at the same time opens the door to other opportunities, such as collaborating with other developers so players can transfer assets between games. Developers can also earn extra revenue by charging a fee.

Although the current NFT usage is very much concentrated in the main categories of collectibles, art and gaming, the application of NFTs goes far beyond. With over $100 million dollars worth of NFTs traded and $6 million in just one month. The NFT space is one of the fastest-growing niches in crypto. The NFT ecosystem is disrupting other industries such as luxury fashion, real-world assets and complex financial products, including DeFi lending, insurance, bonds and options. The potential is enormous.

Solving the problem of counterfeiting

Italian designer

Angelo Galasso is regarded as the pioneer in the high-end menswear fashion industry and is one of the early adopters leveraging the power of NFTs in the world of luxury. His brand is now in collaboration with acclaimed digital artist -

Lee Robinson

and technology ecosystem –

EdenBase. The team has launched a series of NFTs that comprise unique pieces of digital art, luxury accessories, all individually handcrafted by artisans in Italy, exclusively created for NFT owners. When shoppers buy a piece of Robinson's unique digital art, they will also get one of Galasso's limited edition monogrammed accessories, custom-designed and beautifully handmade, delivered to their door.

Source: AngeloGalasso.com

Source: AngeloGalasso.com

Delivering a better brand experience

While makers of high-end goods such as

Gucci,

Chanel,

YSL

justify their high price-tags by pointing to their pricey materials and craftsmanship, these traits are only part of their value. Luxury is the business of building identity. Buying luxury goods for many is a way to increase self-esteem, create a sense of accomplishments and provide a sense of belonging to the brand culture.

Behavioural science research suggests that shoppers don't buy a luxury handbag because of its incredible utility. Of course, the leather is oh-so-soft, the logo is flashy, and the quality is exceptional. All of these rich qualities are proclaiming the rich status without the owners having to say anything. A digital asset can be copied, but the private key on the blockchain proving the ownership is unique and cannot be replicated or destroyed. NFTs reinforce the

scarcity, exclusivity and authenticity that are vital to the perceived worth of luxury goods.

NFTs as collateral in DeFi lending

Currently, the vast majority of DeFi lending protocols are collateralised. It means that borrowers are able to supply NFTs representing a digital asset such as a piece of art, a meme, a digital land or a tokenised real estate as collateral and borrow money against it. Unlike collateral used on standard DeFi borrowing and lending platforms, the value of the collateral can be easily measured by integrating price oracles from multiple liquid sources such as centralised and decentralised exchanges. Due to the illiquid nature, lack of transparency in price movements, and the extreme volatility of the NFTs market, the price discovery process is tricky and measuring the value is challenging.

Imagine if someone buys a

HyperDragon

for 10 ETH and later uses this dragon as collateral on one of the DeFi lending platforms such as Compound or AAVE, and draws 1750 DAI, assuming that 10 ETH is worth $3500 and this particular NFT has 50 per cent LTV. If no one is willing to buy this

HyperDragon, then the market for this NFT is illiquid or non-existent. The only assumption we can make is that this NFT is still worth the same amount as it was last sold for, which is 10 ETH.

In the wildland of NFTs, values can change dramatically in the blink of an eye. To address this problem, some of the projects that offer NFT collaterised loans are adopting the Peer-to-Peer (P2P) Marketplace lending model instead. This space is still extremely early in its development, but in this model, borrowers can offer NFTs as collateral and lenders can choose which NFTs they are willing to accept before releasing a loan. The collateralised NFT is kept in an escrow contract. If the borrower defaults on the loan, the collateralised NFT asset will be transferred to the lender.

One of the companies that use this model is

NFTfi. Borrowers can put any ERC-721 token up for collateralisation and other users can offer the borrower a loan. Once the borrower accepts a loan, the ETH gets paid out from the lenders account to the borrower, and the NFT gets locked in the

NFTfi

smart contract. Once the borrower repays the loan, including the interest, the asset will be returned to the borrower. If the borrower misses a repayment or defaults on the loan obligation, the NFT will be transferred to the lender.

Eye-watering prices in the crazy world of NFTs

We know that crypto cannot do small numbers and NFTs are duly getting on with the program.

In terms of market capitalisation, the NFT industry grew by 17 per cent in 2019 and tripled in 2020. The total value of transactions increased by 299 per cent year on year. According to

CoinGecko, the NFT market capitalisation has exceeded its 2020 forecast and reached over $550 million USD.

NFT sales came close to $1 million USD in the first week of September 2020. In the first week of December 2020, $2 million USD worth of NFTs changed hands. As per data from

DappRadar,

| the trading volume across the top three NFTs marketplaces,

OpenSea,

SuperFarm

and

Rarible, came to $342 million USD in February alone this year.

To some people, NFT represents the latest evolutionary stage of cryptocurrency, a new and ingenious way to break from traditional asset classes. To others, NFT is a senseless bubble and yet another way of parting fools from their money.

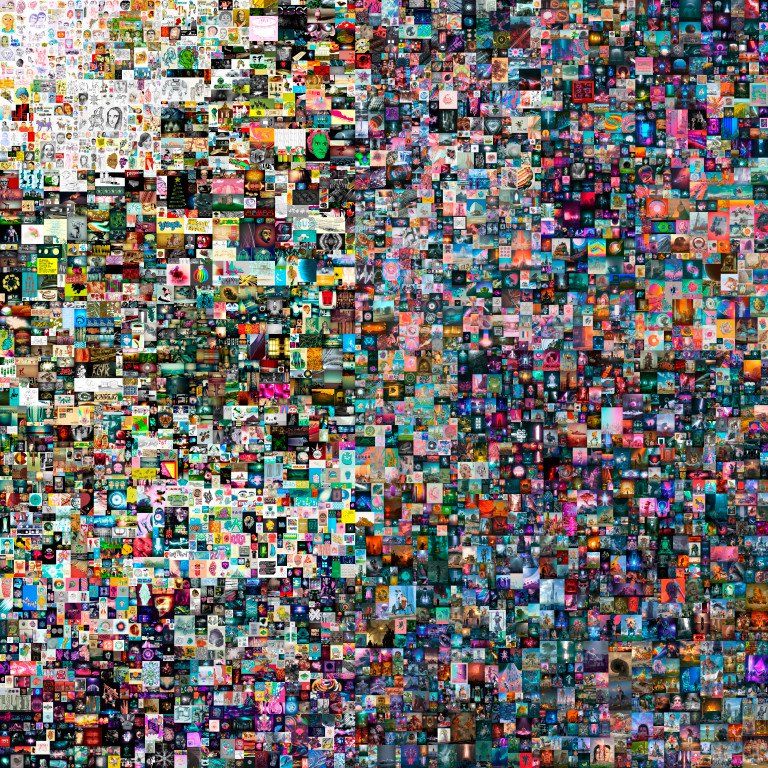

As the NFT market booms, records are constantly being broken. This year, the market reached new levels of hype after the NFT-based artwork

'Everydays: The First 5000 Days'

by

Beeple

sold at

Christie's Auction House for an astounding

$69.3 million USD in front of 22 million viewers on 11 March, 2021, setting the world record for most expensive digital artwork sold and the third most expensive artwork by a living artist at auction.

The craze has driven scores of people to put up their own digital art and tweets for sale as NFTs.

Tom Brady is the latest athlete to get into the NFT business by creating his first NFT, even toilet paper companies are trying to ride the NFT wave with

Charmin selling its owned toilet paper crypto art called

"Non-Fungible Toilet Paper".

Below are some of the other NFT transactions to date that changed hands for truly jaw-dropping sums of money.

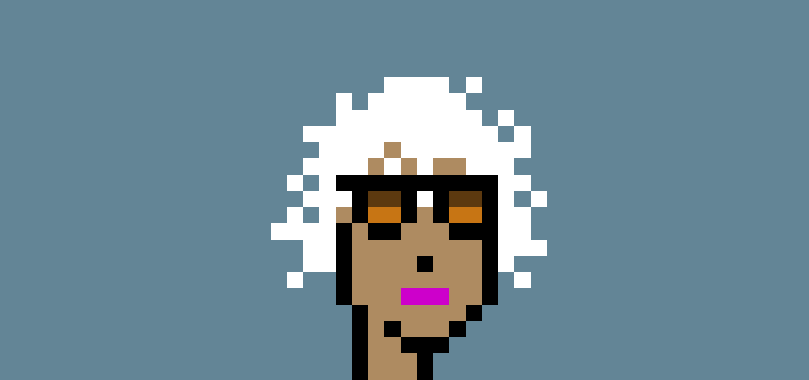

CryptoPunk #7804:

$7.5 Million USD

CryptoPunks first launched in June 2017 and were developed by a two-person team of

Hall and Watkinson, at American Game Studio

Larva Labs. They are 24×24 pixel art images that are algorithmically generated.

CryptoPunks were released before

CryptoKitties. They are innovators in the NFT space and were one of the inspirations for ERC-721 tokens.

CryptoPunks is currently the most popular NFT art marketplace by weekly and total traded USD volume. According to

BraveNewCoin.com, there has been $9 million USD worth of CryptoPunks traded in the first week of April 2021.

Noah Davis, Associate Vice President, Head of Digital Sales in the Post-War and Contemporary Art department at

Christies Auction House in New York, describes CryptoPunks as

|

the 'Alpha and Omega of the crypto art world' and says this will be a 'historic sale.'

CROSSROAD:

$6.66 Million USD

CROSSROAD is an NFT created by acclaimed digital artist

Beeple and this piece of artwork has been resold on a secondary NFT market for $6.6 million USD on 26 Feb 2021. It features anti-Trump messaging and an enlarged Donald Trump-like figure is lying in a defeated heap with profanities written across his naked body. The artwork was designed to change based on the outcome of the 2020 election. Had Trump won, it would have depicted him wearing a crown and striding through flames.

NYAN CAT:

$590,000 USD

The world's hottest cat is no longer CryptoKitty #896775 - Dragon, which was sold for $172k in 2017. Holding the crown for the

'Hottest Cat in the World - 2021'

is proudly the

Nyan Cat, a cat meme created by

Chris Torres

– a quirky flying space cat with an 8-bit rainbow Pop-Tart body, released on YouTube in 2011, sold for 300 ETH, a whopping $590,000 USD in February this year.

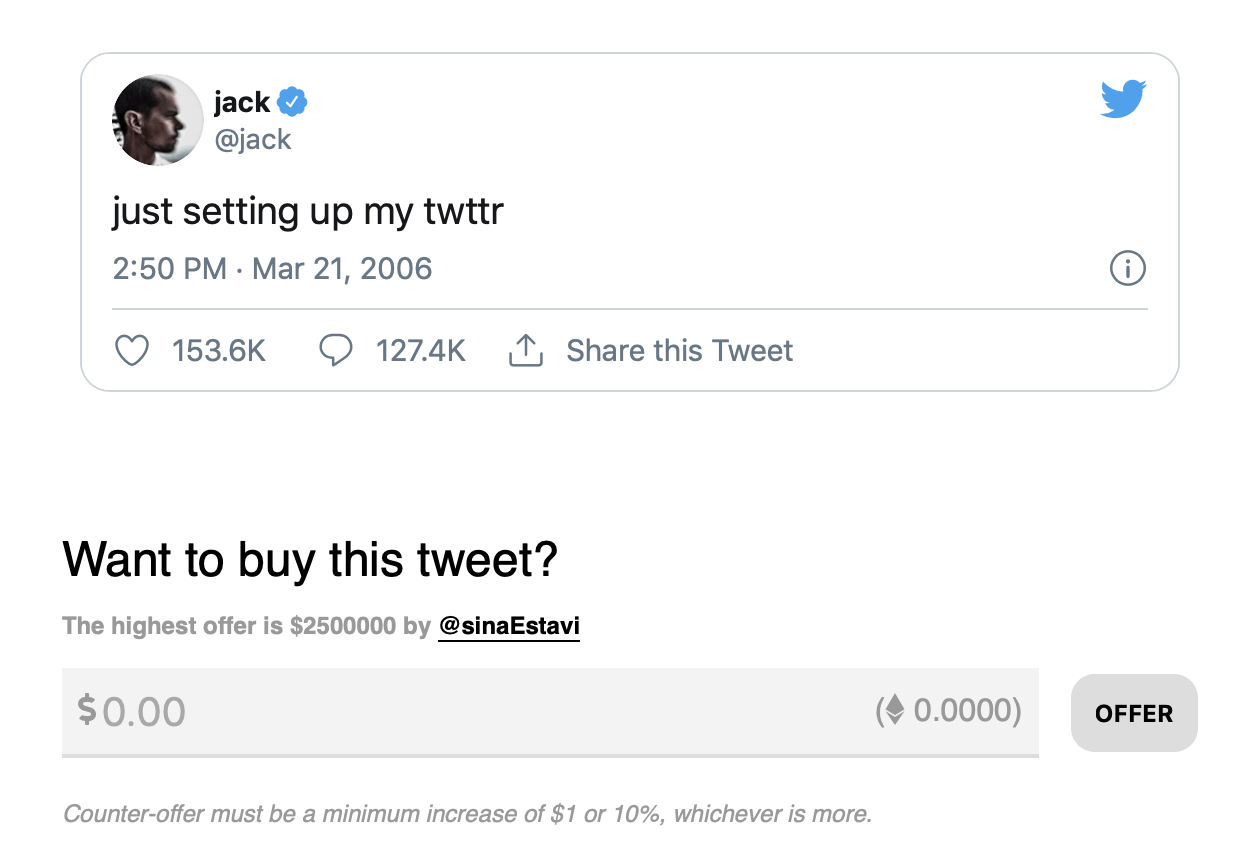

First Tweet by Jack Dorsey:

$2,915,835.47 USD

Twitter CEO

Jack Dorsey has sold his first tweet

"just setting up my twttr"

from 21 March, 2006, as an NFT for 1630.5825601 ETH, or the weirdly specific figures of $2,915,835.47 USD, on the NFT platform

Valuables. The winning bidder was

Sina Estavi, CEO of blockchain company

Bridge Oracle, who had held the high bid since offering $2.5 million USD on 6 March 2021. No one seems to know the story behind the weird specific amount.

Is NFT a bubble waiting to burst? Some critics believe that NFT bubble bursting is

not a matter of if but when - just like the 'Tulip-Mania' in the 17th Century.

Source: L Boissoneault, Smithsonian Magazine

According to NFT marketplace data monitor

NonFungible.com,

| the average daily value of NFTs fell from $19 million USD to $3 million USD on 25 March, 2021 – a decline of over 85 per cent on average.

Popular NFT items like

NBA Top Shot

and

CryptoPunks also have seen their average value and number of transactions on the decline since they peaked in mid-February 2021.

CryptoPunks, among the earliest and most popular NFT projects for collectors, have seen an over 40 per cent decrease in floor price to 14 ETH.

The price capitulation has led to some speculators liquidating their positions in punks and taking a loss. One speculator has sold a Punk for 16 ETH after buying it for 25.5 ETH and another speculator has sold

Punk#8282, one of the 3840 female punks created, with crazy white hair 27.99 ETH after a 42 ETH purchase.

In liquid markets, you can see where prices are going every day on open exchanges, but In NFT-land, sellers have slower market reaction

due to the illiquid nature of NFTs. There is a lack of price transparency and the general market sentiment is very difficult to gauge.

If the market is in a downward trend, instead of sellers adjusting prices downwards every day for a month, forming a trendline, it may be just down 80 per cent overnight.

The price has moved extremely fast in the NFT space, especially from January to February this year. The rate of the increase was so fast that it was almost unsustainable. We all know that

Sir Isaac Newton's universal law of gravity that what goes up will come down.

Perhaps the NFT market is experiencing a 'silent crash'. It is perfectly healthy to see a short-term correction. No doubt that the NFT space will continue to grow. Like all collectibles, most of them will be worth nothing, and there will be a tiny percentage worth a lot.

The rise of NFTs in the crypto world has made our wildest dreams come true, virtually.

For

pet lovers, they can now own that pet dragon they've always wanted in a virtual cave, and feeding it with virtual edamame. For

art collectors, they can now have a digital artwork gallery that fits in their pockets. They can turn their phones into a digital museum that they can take around to show families and friends.

For the famous 8-bit rainbow

Nyan Cat, it has meowed all the way to the moon, proving to the world that meme power is real and here to stay. It wouldn't surprise me that in the not-so-distant future, passports, electoral votes, licences, properties, digital IDs, anything that requires uniqueness will be tokenised and given in NFTs.

My 8-year-old didn't get the dragon that promised to rule the planet, but instead, he got three cute dragons that didn't break the bank. He was over the moon that he had these little warriors in his dragon collection that he can train, breed and send to the battlefield. I also had tremendous satisfaction from my very first shopping experience using my crypto wallet. To me, that is a win-win.

Some final thoughts

After creating this blog post, I feel like I have just woken up in the Matrix. As much as I love cats, I still wouldn't pay $590,000 USD for a feline, regardless of its colour. Was it an accident, money laundering, or a joke taken seriously by mistake? I don't have the answers. Perhaps the world has completely lost its mind in the space of NFTs.

While some people think that NFT is the biggest technology insanity ever, I am still a firm believer that NFT is going to be incredible and inevitable. Like all crazy inventions throughout history, they are a pre-cursor for innovation. Similar to the world wide web in 1989 and social media platforms in the early 2000s, NFT is not something that will just go away, at least not in my lifetime.

References

Why do we collect things? Love, anxiety or desire, Christian Jarrett, 2014,

https://www.theguardian.com/lifeandstyle/2014/nov/09/why-do-we-collect-things-love-anxiety-or-desire;

Christie's announce May auction of 9 CryptoPunk NFTs, Aditya Das 2021,

https://bravenewcoin.com/,

Photos Credited By

Cabinet of Curiosities, Domenico Remps, c. 1690, Natural history museu of Ole Worm, Museum Wormiani Historia, 1655,

NFTP: Charmin, 2021

Tulip Mania: Lorraine Boissoneault, Smithsonian Magazine, 2017

Disclaimer

This article is for general informational purposes only. I give no warranty and accept no responsibility or liability for the accuracy or the completeness of the information and materials contained in this article and on this website. Under no circumstances will I be held responsible or liable in any way for any claims, damages, losses, expenses, costs or liabilities whatsoever (including, without limitation, any direct or indirect damages for loss of profits, business interruption or loss of information) resulting or arising directly or indirectly from your use of or inability to use this website or any websites linked to it, or from your reliance on the information and material in this article and on this website.